New Tax Rules 2025 Thailand

New Tax Rules 2025 Thailand – READ MORE Credit card holders warned ‘pay contactless’ and told ‘never enter card’ One of the key HRMC tax requirements 2025 cars first registered from April 2017 will need to pay VED and new . The approval of Hyundai Motor Company’s investment of 1 billion Thai baht (approximately USD 28 million) to set up a facility for EV and battery assembly in Thailand further reinforces the .

New Tax Rules 2025 Thailand

Source : www.thaiexaminer.com

Thailand Revenue Department: Foreign Sourced Income Tax

Source : www.expattaxthailand.com

Ambassador Pedro Zwahlen on X: “Khun Nathanan from @RevenueDept

Source : twitter.com

Thailand’s New Tax on Foreign Income: An Overview

Source : www.siam-legal.com

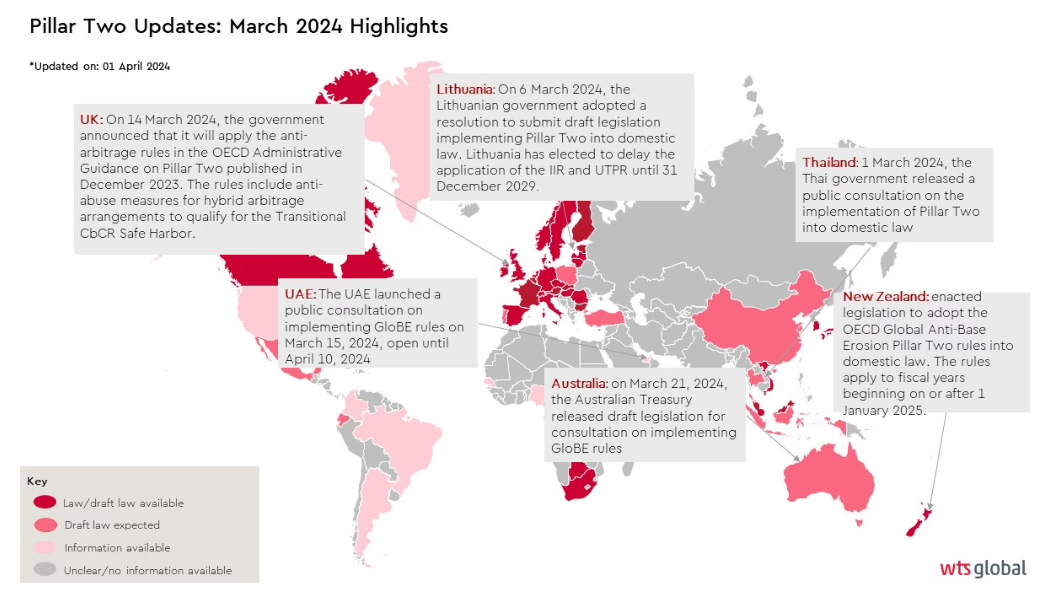

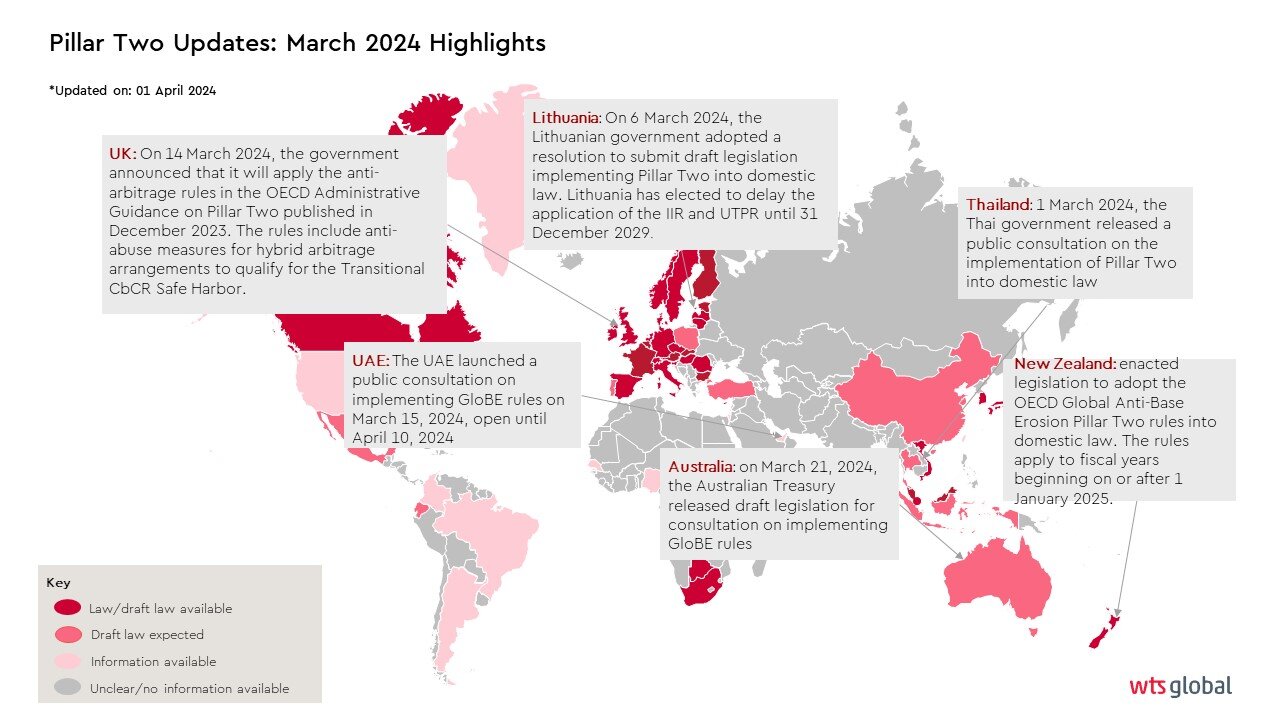

Pillar Two: Updates March 2024 Lexology

Source : www.lexology.com

Thailand Revenue Department: Foreign Sourced Income Tax

Source : www.expattaxthailand.com

Navigating Pillar Two global minimum tax rules

Source : www.pwc.com

Pillar Two: Updates March 2024

Source : wts.com

New tax rules for foreign sourced income Pattaya Mail

Source : www.pattayamail.com

Isaan Lawyers | Nakhon Ratchasima

Source : www.facebook.com

New Tax Rules 2025 Thailand Thai taxman now plans to tax foreigners on all income whether it : Nonresidents are liable to tax on income derived from Thai sources. Married couples may opt to have joint tax liability; although the wife needs to file a separate tax return on her employment income, . More than 900,000 drivers will be forced to start paying Vehicle Excise Duty next year as new 2025, will be liable to pay the current standard VED rate of £190. One of the key HRMC tax .